Opportunities and Challenges Behind the Expansion of steel production in India

According to the vision plan for expanding steel production capacity released by the Indian government in May 2017 - the National Steel Policy (2017), India plans to increase its crude steel production capacity to 300 million tons by the fiscal year 2030-2031 (April 1, 2030 - March 31, 2031). On April 24th this year, Sandeep Poundrik, the secretary of the Ministry of Steel of India, publicly stated again that India is confident of achieving the goal of increasing steel production capacity to 300 million tons by 2030. Given that the Indian government is committed to reducing its reliance on imports and supporting domestic industries, India is actively adjusting its industrial layout to achieve this strategic goal.

Judging from the market performance, the growth momentum of the Indian steel industry is obvious. In 2024, the world's crude steel output was 1.839 billion tons, a year-on-year decrease of 0.9%, among which India's output was 149.6 million tons, a year-on-year increase of 6.3%. In the first four months of 2025, the average monthly year-on-year growth rate of India's crude steel output remained at 6% to 7%, with a year-on-year increase of 5.6% in April, reaching 12.9 million tons.

Support from the demand side is the foundation and core driving force for a significant expansion of production capacity. According to the short-term demand forecast released by the World Steel Association in October last year, India's steel demand is expected to increase by 8% from 2024 to 2025, thanks to the continuous growth of all steel-consuming industries, especially the sustained and strong growth of infrastructure investment. During this period, the large-scale infrastructure projects promoted by the Indian government have greatly facilitated the construction of local infrastructure such as residences, roads and railways, and driven the growth of demand in the construction industry. Meanwhile, the development prospects of the country's automotive industry are optimistic, and the demand for automotive steel is also continuously increasing. India is the world's third-largest automotive consumer market, only after China and the United States.

Against this backdrop, the Indian steel industry can leverage the growth momentum of its domestic economy to embrace the favorable opportunity of increasing demand.

However, the instability of the investment environment, the shortage of technological innovation and professional talents, coupled with the transformation pressure brought about by the carbon neutrality goal, are also the obstacles that it must face and cannot overcome in order to achieve the goal.

In terms of green and low-carbon development, the Indian government has set a target, planning to reduce total carbon emissions by 30% to 35% by 2030 compared to 2005. In 2024, the "Green Steel" guidelines issued by the Indian government provided a framework for the green and low-carbon development of the country's steel industry and promoted the implementation of green star classification for steel products.

In addition, the Indian government has decided to impose a temporary tariff of 12% on some imported steel products for 200 days starting from April 21st to protect the domestic steel industry. The imposition of tariffs by the Indian government can protect India's steel enterprises in the short term, but in the long run, it is not conducive to its own upgrading and transformation as well as industrial development. The international competitiveness of India's steel industry is insufficient, which leads to a lack of motivation for enterprises to make technological progress and strengthen management. Moreover, the equipment, technology and management capabilities of Indian steel enterprises are also relatively low. On this basis, there is still a serious reliance on imported technology in India's high-end steel production. The shortage of high-end technology and talents is also an important issue that the country has to confront directly.

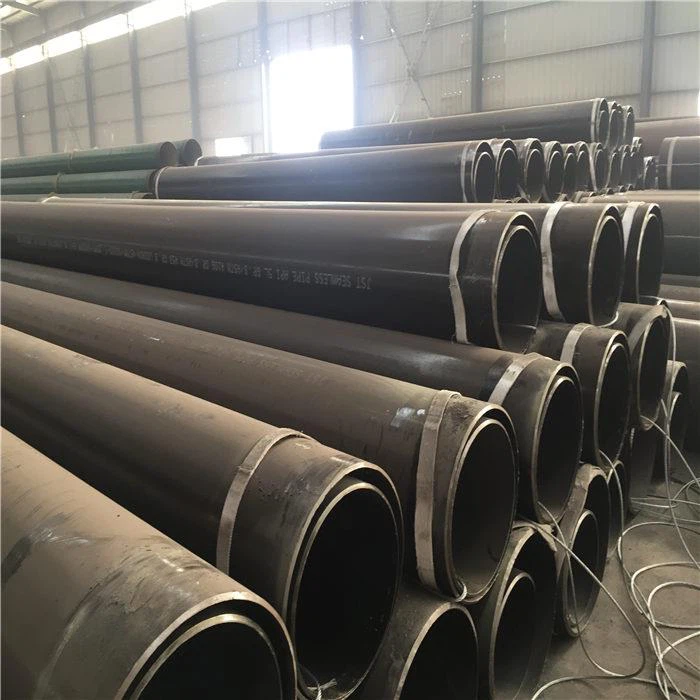

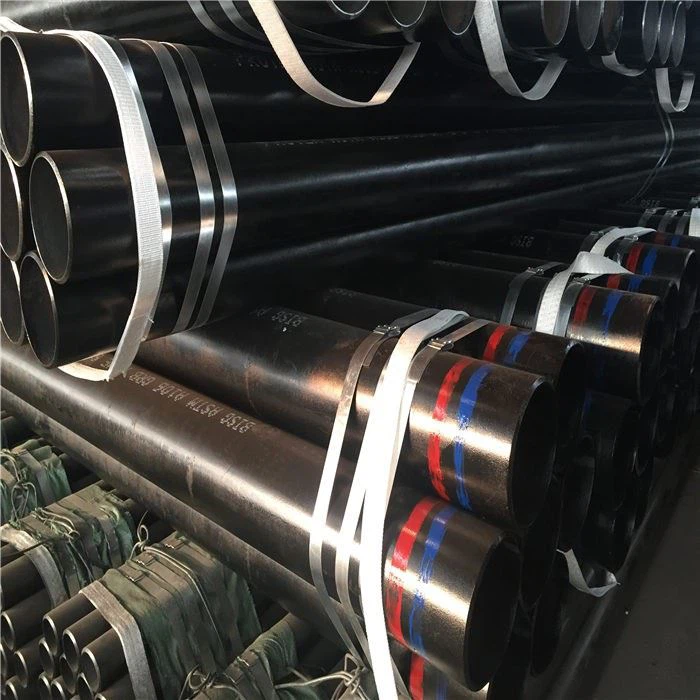

My company hot sale seamless steel pipes:

ASTM A106 B seamless pipes,(1” to 24” sch40, sch80),

API 5L GR.B steel pipes, (seamless pipe, 1” to 30” sch 40, sch80),

Boiler tubes,( 20G. 12Cr1MoVG, ASTM A335 P5, P9, P11),

ASTM A333 GR.6 seamless pipes, ( 1” to 24” sch40, sch80, sch160),

API 5CT seamless casing, and tubing, (2 3/8” to 20” K55, J55, N80, L80, P110),